How to Understand My Fund Statement

Each spring the Foundation sends fund statements to all our fund holders.

Click the links below for additional information:

Annual Reports and Financial Statements

Fund Statement Glossary

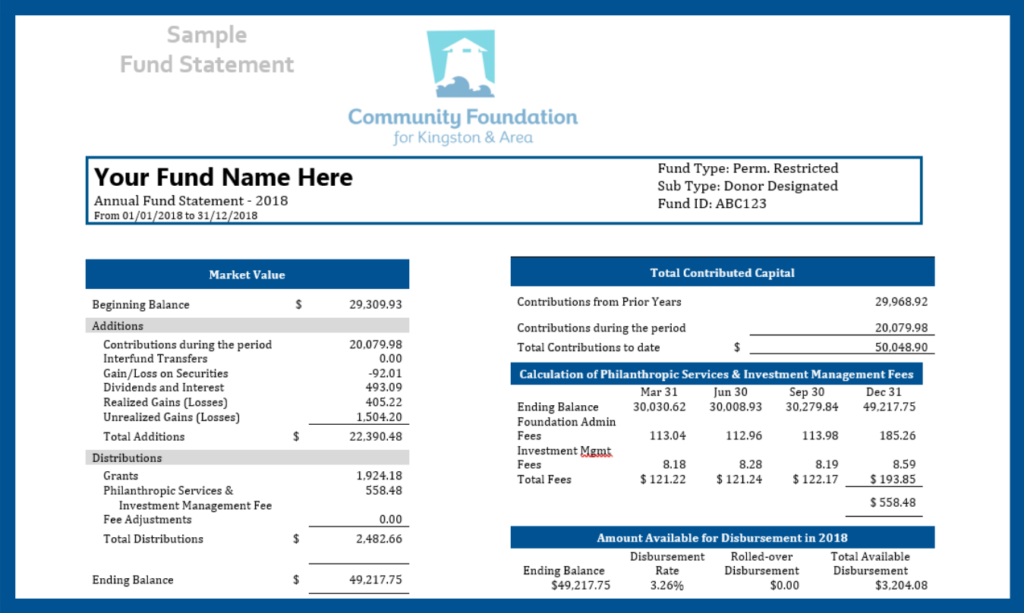

1 – Market Value

This section gives an overview of all changes to your fund:

Beginning Balance: The total value of the fund as at the beginning of the statement period. This includes the invested donations and accumulated net investment gains or losses from prior years.

Interfund Transfers: Donations to this fund from other funds held at the Community Foundation.

Gain/Loss on Securities: The gain or loss on the sale of gifted securities. Donated securities are issued a charitable receipt for the value of the shares on the day they are donated (the price at the end of the day). It is our policy to sell them as soon as possible (in most cases the morning of the next trading day), but the price may vary from when the shares were valued.

Realized Gains (Losses): Gains or losses due to selling a particular investment in the Foundation’s investment pool, based on comparing the selling price to the original purchase price.

Unrealized Gains (Losses): Gains or losses due to a change in market value of an investment. During the course of a year, certain investments may gain or lose in value through movement in the stock market. If an investment is held over the course of the year and into the next, any gain or loss on value is called “unrealized” because the investment is being held and not sold.

Grants: Disbursements (payments) from the fund to registered charities during the reported period.

Philanthropic Services & Investment Management Fee: Administrative fees charged by CFKA to your fund as per the fund agreement, and fees charged by the investments brokers which can be incurred.

Ending Balance: Total market value of invested donations and accumulated net investment income/gains of the fund, less any approved disbursements and fees, as at the end of the reporting period.

2 – Total Contributed Capital

Total Contributed Capital: Donations to your fund, recorded at their original value and not adjusted for changes in market value or investment income. The capital contributions balance is only changed by additional donations to the fund.

3 – Calculation of Philanthropic Services & Investment Management Fees

Ending Balance: Total market value of invested donations and accumulated net investment income/gains of the fund, less any approved disbursements and fees, as at the end of the reporting period.

Foundation Admin Fees: Administrative fees charged by CFKA to your fund as per the fund agreement

Investment Management Fee: fees charged by the investments brokers which can be incurred.

4 – Amount Available for Disbursement in 2020

Ending Balance: Total market value of invested donations and accumulated net investment income/gains of the fund, less any approved disbursements and fees, as at the end of the reporting period. The ending balance is used to calculate available for disbursement.

Disbursement Rate: The payout rate for your fund, which is calculated annually. By our current policy it is determined as 70% of the average rate of return of the previous three years, less fees. It is guaranteed to be a minimum 2.5% but may be capped at 3.5% should the market value of your fund dip below its total contributed capital. The rate is subject to the terms of your fund agreement, contributed capital, and CFKA’s financial management policies.

Rolled-over Disbursement: The remaining unspent granting amounts from preivous years.

Total Available Disbursement: Total amount available to be granted out for the fund including any rolled-over amounts.

Enhanced Spending Funds

Your enhanced spending fund may also show a line called “Less: Encroachment on capital”. Encroachment on capital can result from a combination of enhanced spending, administration fees, and lower market returns.

Still have questions?

We are happy to answer any questions you may have about your statement. Please call 613.546.9696 or email finance@cfka.org

I NEED FUNDING

275 Ontario Street Suite #100

Kingston, ON K7K 2X5

Phone: 613.546.9696

Fax: 613.531.9238

Email: info@cfka.org

275 Ontario Street Suite #100

Kingston, ON K7K 2X5

Phone: 613.546.9696

Fax: 613.531.9238

Email: info@cfka.org