Professional Advisors

By partnering with the Community Foundation for Kingston & Area, professional advisors like you can help your clients fulfill their unique charitable goals in tax effective ways.

The Foundation can work with you and your clients to set up a named charitable fund – an investment that benefits the community year after year and creates a personal or family legacy.

We’re Here to Help

Working with the Community Foundation, your clients have the flexibility to shape their own charitable giving to reflect their personal goals and desires; now or through a bequest gift.

Whether they want to address an urgent need in the community, memorialize a loved one, or help out a charity with a specific project, we have a giving option to help them make an impact and improve the lives of others in the community in a way that is meaningful to them.

We offer a variety of fund types – including Donor Advised and Designated Funds – and make setting up a charitable fund as simple and convenient as possible. Funds can usually be set up within a day or two, with a pledge of only $10,000.

Many individuals and families choose to work with the Community Foundation as an alternative to setting up a private foundation because of our connections to the community, and simply because it is easier administratively. It’s like having their own family foundation, but without all the expense and book-keeping. We also offer a permanent solution to your clients’ giving needs, so that families can be assured their legacy will be upheld for generations.

The investment approach used by CFKA is a passive-based approach that tracks broad market indices. We have chosen this approach because it is a very low cost approach to investing, which keeps more money in our endowment funds, and we mitigate company-specific risk by spreading our risk amongst all the company participants in the indices we use.

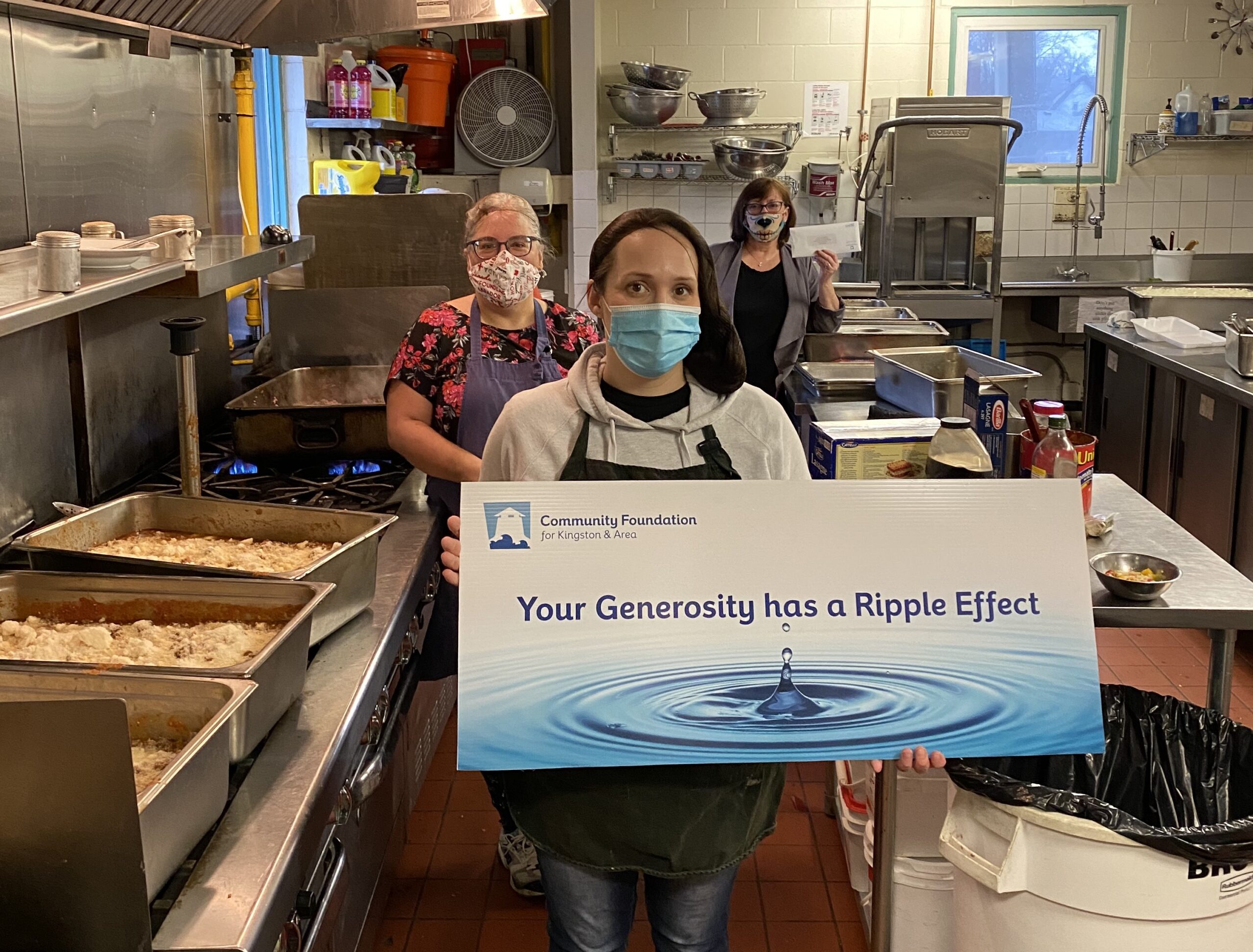

Check out these Donor Stories to see how other donors are working with the Foundation!

Tips, Tools & Resources

How to set up a Fund with the Foundation

The benefits of gifting appreciated securities

Forms for your client to donate appreciated securities for maximum tax advantage

Sample wording for charitable bequests in Wills

Professional Advisor e-Resource

More Information

As a professional advisor, you can help your clients realize their personal philanthropic vision. With our knowledge of community issues, experienced granting and flexible giving options, we can provide you with the resources you need to help better serve your client.

Please contact us if you’d like to:

- meet to discuss a client’s specific interests

- receive an information package

- receive ongoing updates about the Foundation

- book an information session for your staff

To learn more about how we can help, please contact Stacy Kelly, Executive Director, at ed@cfka.org or 613.546.9696.

I NEED FUNDING

275 Ontario Street Suite #100

Kingston, ON K7K 2X5

Phone: 613.546.9696

Fax: 613.531.9238

Email: info@cfka.org