20th Annual Zal and Rose Yanovsky Breakfast Fundraiser December 12 & 13

“Together they committed themselves to make Kingston a vibrant place to live.”

Join us for the 20th Annual Zal & Rose Breakfast!

The Community Foundation for Kingston & Area (CFKA) is pleased to announce the 20th anniversary of the Zal and Rose Breakfast fundraiser in support of The Food Sharing Project, which provides over 10,000 healthy meals each week to students in 88 schools across KFL&A.

The breakfast is a collective effort – staff donate their time, Chez Piggy and Pan Chancho donate all of the food, and suppliers often contribute food to the cause as well. To-date, the Fund has granted $245,444 to The Food Sharing Project, and the legacy of Zal and Rose lives on by helping to feed thousands of children each year.

Dine-In or Take-Out Options

After four years absence, Chez Piggy will provide a dine-in option for guests. “We’re so excited to welcome new guests and old friends back to Chez Piggy by offering a sit-down dine-in breakfast this year,” says Zoe Yanovsky. Dates for this year’s breakfast fundraisers are:

Tuesday, December 12th, 2023: 7:00am-9:00am

Chez Piggy (dine-in only), 68 Princess St, Kingston, ON K7L 1A5

Please call 613-549-7673 to reserve your breakfast.

Wednesday, December 13th, 2023: 7:00am-9:00am

Pan Chancho (take-out only), 44 Princess St, Kingston, ON K7L 1A4

Please call 613-544-7790 to reserve your breakfast.

About The Zal and Rose Yanovsky Breakfast Fund

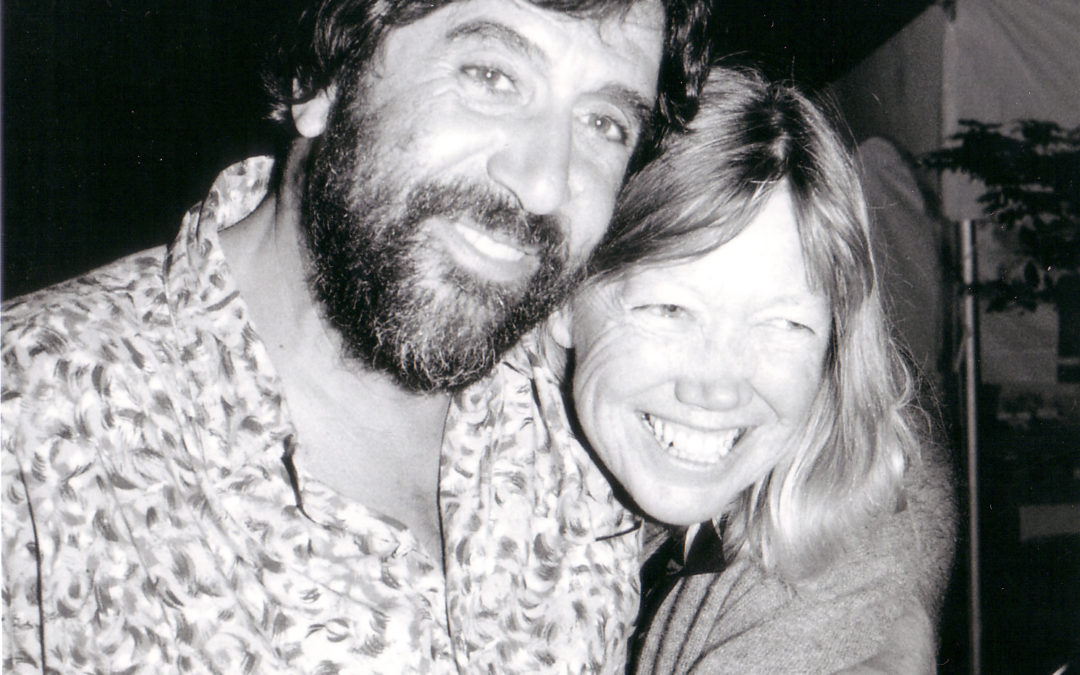

In memory of Zal Yanovsky and Rose Richardson, supports school breakfast programs for children in Kingston and area. Zal Yanovsky and Rose Richardson were two of Kingston’s best known and beloved citizens. Zal was larger than life, Rose was his anchor. Together they committed themselves to make Kingston a vibrant place to live. They generously donated their time, talent and energies to giving back to their community.

Zal died very suddenly in 2002. Rose was passionate about making sure that kids in schools had nutritious meals. So a group of friends, colleagues and loyal patrons of Chez Piggy and Pan Chancho and launched the Zal School Breakfast Fund, an endowment fund with the Community Foundation of Kingston in 2004. Rose lived long enough to see the success of the breakfasts. She died in 2005. Zal’s daughter, Zoe, is carrying on the tradition of Zal and Rose, the breakfasts are now an annual tradition each December.

The endowment fund continues to grow and the legacy of Zal and Rose lives on by helping to feed thousands of children each year. Watch a video about Zal and Rose Yanovsky Breakfast Fund.

I NEED FUNDING

PROFESSIONAL ADVISORS

For Professional Advisors

Benefits of Working With Us

Tools and Resources

How to Set Up a Fund

275 Ontario Street Suite #100

Kingston, ON K7K 2X5

Phone: 613.546.9696

Fax: 613.531.9238

Email: info@cfka.org

275 Ontario Street Suite #100

Kingston, ON K7K 2X5

Phone: 613.546.9696

Fax: 613.531.9238

Email: info@cfka.org