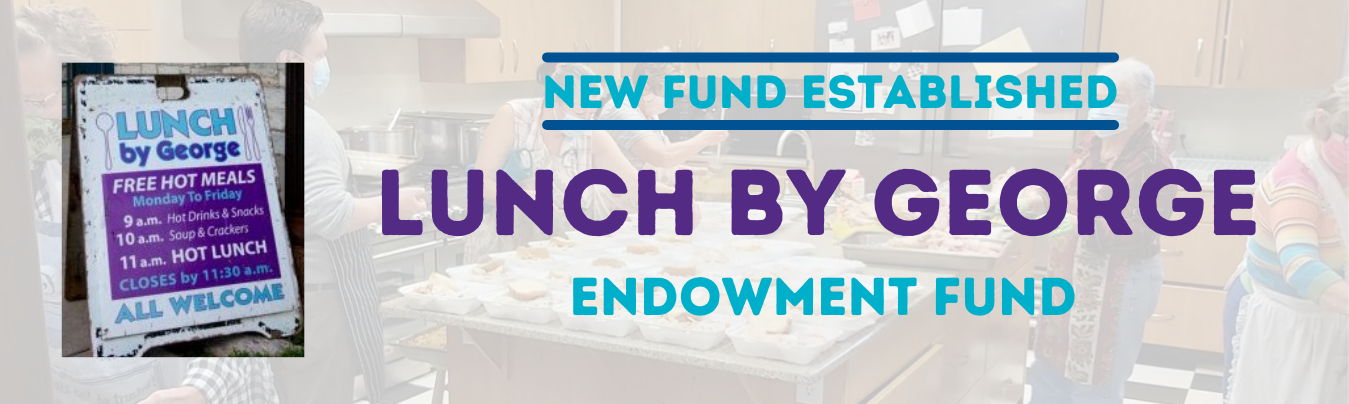

Lunch by George Endowment Fund

Lunch by George has been run by the charitable organization Outreach St. George’s Kingston (OSGK) since 1985. This popular lunch program operates five days a week out of St. George’s Hall on Wellington Street, providing healthy, hot meals at noon. They normally serve 60 people per day, but their numbers have skyrocketed to up to double that during the pandemic.

In addition to providing a hot meal – often their only meal of the day – Lunch by George has become the social centre for many; a place where people know and care for each other. Blake, who hands out the food at the window, knows all their clients by name, and always interacts with each person in a very positive way. Their clients are very appreciative and often end their visit with a word of gratitude and “see you tomorrow!”

Lunch by George patrons come from a range of backgrounds, with many living with some form of disability – mental or physical – that prevent them from working. A survey done several years ago showed that most were on disability, pension, or welfare assistance, with rents consuming 30 to 50% of their incomes. Many have no cooking facilities – maybe just a hotplate.

“We treat all of our clients with respect and do our best to provide other things they might need, such as warm clothing, hats and gloves, and then on our coat give-away day they have the opportunity to come inside the door and try on the ones they like and choose one that suits them,” said Tanis Fairley, Co-Chair of OSGK.

Facing increasing demands and rising operational costs, the Board of OSGK is embarking on building an endowment fund that will provide a sustainable source of income to support the Lunch by George program each year, so that they are always there to provide a hot lunch to those in need.

They are hoping to take full advantage of the Community Foundation’s dollar-for-dollar match to kick-start their new fund. The Foundation will match all gifts received by December 31, 2021, of up to a total of $10,000.

Donations to the Lunch by George Endowment Fund can be made in many convenient ways:

- on-line through Canada Helps (see donate now button below);

- by cheque payable to: Community Foundation for Kingston & Area

with “Lunch By George Endowment Fund” in the memo line; - by credit card, by calling the Foundation office at 613.546.9696;

- or, for maximum tax advantage, gifts of appreciated securities (stocks, bonds, mutual funds). Please contact the Community Foundation office for details.

I NEED FUNDING

PROFESSIONAL ADVISORS

For Professional Advisors

Benefits of Working With Us

Tools and Resources

How to Set Up a Fund

275 Ontario Street Suite #100

Kingston, ON K7K 2X5

Phone: 613.546.9696

Fax: 613.531.9238

Email: info@cfka.org

275 Ontario Street Suite #100

Kingston, ON K7K 2X5

Phone: 613.546.9696

Fax: 613.531.9238

Email: info@cfka.org